Hire fast. Grow faster.

Hire vetted, qualified, reliable talent within a week.

“Globally sourcing talent has opened up the ability for us to recruit the best talent no matter where they’re at and it has also opened up our mind of the impact that we can have“

--Luke Acree, President, ReminderMedia

Learn how Edge can help solve your most pressing workforce challenges.

Hiring Solutions

Utilize our global talent network to hire the best employees.

Fast, easy access to high-quality, pre-screened talent

Fast, easy access to high-quality, pre-screened talent 100% English fluency

100% English fluency Hand-picked matching to meet your specific needs

Hand-picked matching to meet your specific needsTraining & Onboarding

We ensure your new employee integrates quickly and easily.

Pre-trained via Open Academy, our 30-day proprietary training program

Pre-trained via Open Academy, our 30-day proprietary training program All technology and equipment provided to each remote employee

All technology and equipment provided to each remote employee Activation of your preferred remote communication methods

Activation of your preferred remote communication methodsManage & Support

We handle a full range of employee management tasks on your behalf.

Benefits

Benefits Payroll

Payroll Compliance

Compliance IT Support

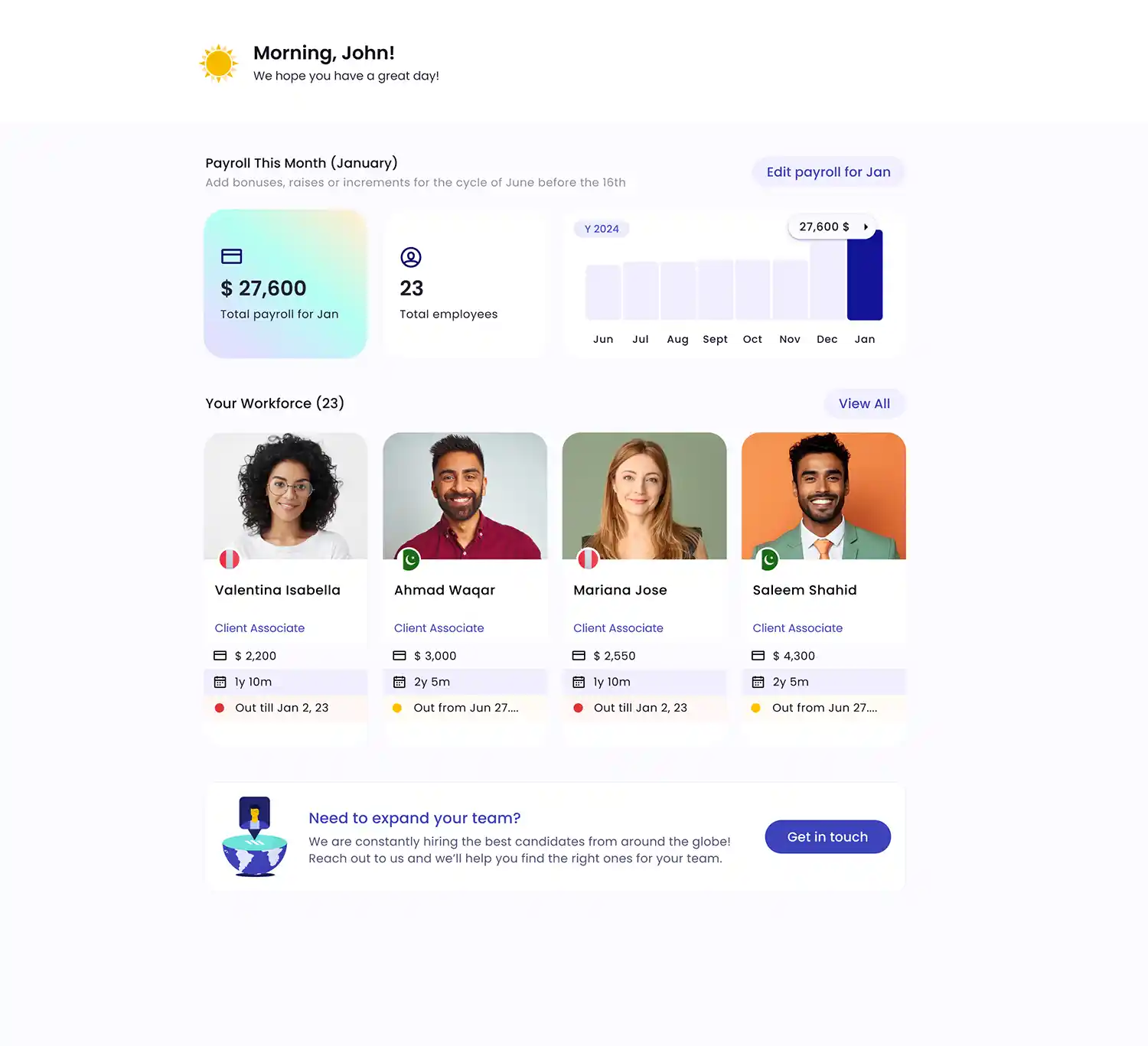

IT Support Your personalized talent dashboard lets you efficiently manage your remote employee payroll.

01

A consolidated view of your payroll and team status

Complete visibility of your workforce & their payroll

Disrupting Norms

We provide companies with a new, better way to get work done through our global network of high-quality, reliable full-time talent.